Financial Accounting teaches key accounting concepts and principles to illuminate financial statements and unlock critical insights into business performance and potential. Explore how managers, Wall Street analysts, and entrepreneurs leverage accounting to drive strategic decision-making.

Financial Accounting

Financial Accounting

Discover What’s Behind the Numbers in Financial Statements

Financial Accounting teaches key accounting concepts and principles to illuminate financial statements and unlock critical insights into business performance and potential. Explore how managers, Wall Street analysts, and entrepreneurs leverage accounting to drive strategic decision-making.

What You'll Learn

- Discover how balance sheets, income statements, and cash flow statements are developed and how each interact

- Evaluate the financial health of a business using financial statements

- Understand GAAP and IFRS standards

- Prepare and evaluate financial forecasts to make strategic decisions

- Value a venture, project, or investment opportunity and perform a sensitivity analysis

About the Professors

V.G. Narayanan is the Thomas D. Casserly, Jr. Professor of Business Administration at Harvard Business School and chair of the MBA program’s second-year elective curriculum. He has served as the course head for the first-year required accounting course for MBA students, Financial Reporting and Control, and chairs several executive education programs. His research in management accounting focuses on understanding how firms can use incentives and feedback to improve performance.

Who Will Benefit

College Students and

Recent Graduates

Learn the language of business through accounting as you gain the skills and knowledge to analyze financial statements.

Those Considering an MBA

Prepare for the MBA classroom with the program Harvard Business School offers to incoming students.

Mid-Career

Professionals

Gain confidence in your ability to understand financial statements and communicate financial results.

Program Structure

Financial Accounting consists of approximately 60 hours of material delivered over an eight-week period. You can complete the coursework on your own time while meeting regular deadlines.

August 2020

Course Start Date: 05th August

Length: 8 Weeks

Regular price $1,600

Enrolment process needs to be completed 2 weeks prior of the program Start Date

October 2020

Course Start Date: 05th August

Length: 8 Weeks

Regular price $1,600

Enrolment process needs to be completed 2 weeks prior of the program Start Date

January 2021

Course Start Date: 13th January

Length: 8 Weeks

Regular price $1,600

Enrolment process needs to be completed 2 weeks prior of the program Start Date

This course is also part of our three-course Credential of Readiness (CORe) program—consisting of Business Analytics, Economics for Managers, and Financial Accounting—available for $2,250.

Interested in mastering business essentials in CORe?

Note: Participants that enroll in the Financial Accounting course are not eligible to enroll in the CORe program. And if enrolling in the CORe program, participants are not eligible to enroll separately in the Financial Accounting course.

Syllabus

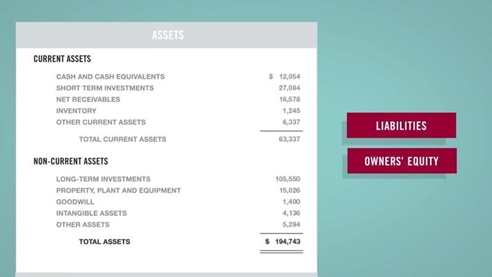

Financial Accounting will teach you the fundamentals of financial accounting from the ground up. You will learn how to prepare a balance sheet, income statement, and cash flow statement, analyze financial statements, and calculate and interpret critical ratios. You will also learn the role of managerial judgment in choosing accounting estimates and methods. The course concludes with an introduction to forecasting and valuation.

Learning requirements: In order to earn a Certificate of Completion, participants must thoughtfully complete all 7 modules by stated deadlines and earn an average quiz score of 50% or greater.

Syllabus

Financial Accounting will teach you the fundamentals of financial accounting from the ground up. You will learn how to prepare a balance sheet, income statement, and cash flow statement, analyze financial statements, and calculate and interpret critical ratios. You will also learn the role of managerial judgment in choosing accounting estimates and methods. The course concludes with an introduction to forecasting and valuation.

Learning requirements: In order to earn a Certificate of Completion, participants must thoughtfully complete all 7 modules by stated deadlines and earn an average quiz score of 50% or greater.

| Modules | Case Studies | Takeaways | Key Exercises |

|---|---|---|---|

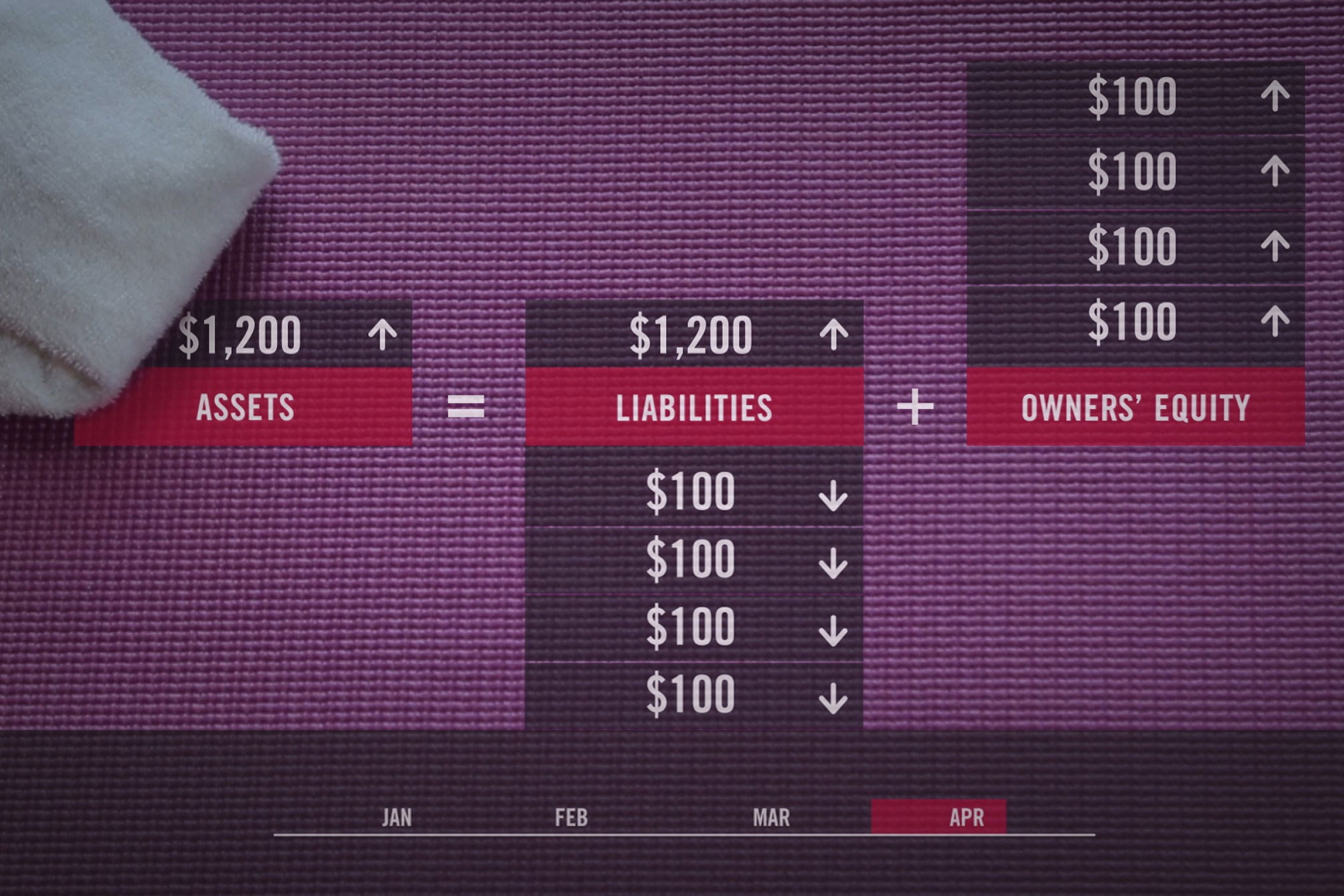

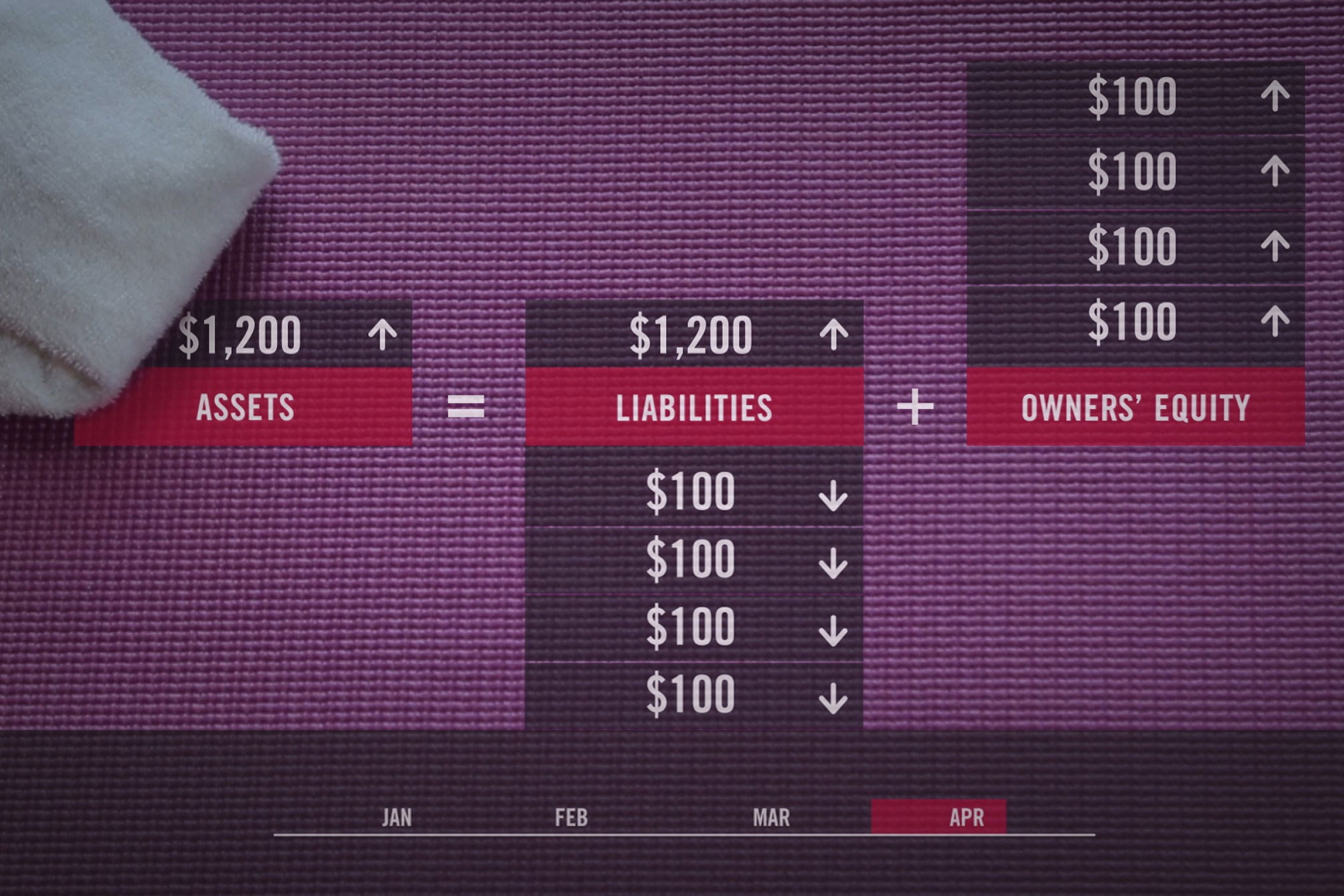

| Module 1: The Accounting Equation |

|

|

|

| Module 2: Recording Transactions |

|

|

|

| Module 3: Financial Statements |

|

|

|

| Module 4: Adjusting Journal Entries |

|

|

|

| Module 5: The Statement of Cash Flows |

|

|

|

| Module 6: Analyzing Financial Statements |

|

|

|

| Module 7: Forecasting and Valuation |

|

|

|

Stories from Our Learners

A few weeks into the course, accounting terminology came alive as I realized why accounting is the language of business. I can now talk confidently with clients and understand the business aspect of their problems.

Daily, I use the accounting principles succinctly enumerated by Professor Narayanan. I especially use what I learned in the volunteer work that I do as a board member for two nonprofit organizations.

Earn Your Certificate

Enroll today in Harvard Business School Online’s Financial Accounting course.

DISCLAIMER:This microsite, Its contents & communication provided is exclusively for the Students, Alumni & Faculty of Ansal University & unauthorized consumption of the same is prohibited.