Alternative Investments will equip you with the skills, confidence, and strategies to assess potential investment opportunities in private equity, hedge funds, and real estate, and enable you to leverage them to maximize value and diversify portfolios.

Alternative Investments

Alternative Investments

Grow the Value of Your Portfolio with Alternative Investments

Alternative Investments will equip you with the skills, confidence, and strategies to assess potential investment opportunities in private equity, hedge funds, and real estate, and enable you to leverage them to maximize value and diversify portfolios.

What You'll Learn

- Speak the language of alternative investments so that you can better communicate and collaborate with your colleagues and customers

- Evaluate alternative investments—including private equity, private debt, hedge funds, and real estate—and identify their defining elements, such as size, risk, and liquidity

- Develop the confidence and ability to assess potential investment opportunities and maximize the value of your portfolio

- Gain the skills and strategies to choose the right alternatives manager or become that future manager yourself

About the Professors

Victoria Ivashina is the Lovett-Learned Chaired Professor of Finance at Harvard Business School and the faculty chair of the Global Initiative for the Middle East and North Africa region. She is also a Research Associate at the National Bureau of Economic Research,a Research Fellow at the Center for Economic Policy Research.

Randolph Cohen is a Senior Lecturer in the Finance Unit at Harvard Business School and teaches Investment Management at MIT Sloan School of Management. His research focuses on the interface between institutional investors’ actions and price levels in the stock market. Cohen has helped start and grow a number of investment management firms, and served as a consultant to many others.

Arthur Segel is a Baker Foundation Professor of Management Practice at Harvard Business School. Segel was a founder of TA Realty, a real estate advisory, investment, and development firm, and co-founded The Tobin Project, a nonprofit that was awarded in 2012 the MacArthur Genius Award for an Organization for its work on inequality. Segel has been named one of the 30 most influential players in real estate in the world by Private Equity Real Estate.

Who Will Benefit

Early-Career Financial Service Professionals es

Gain a competitive edge by developing actionable skills in the alternative investments field you can leverage to advance your career.

Aspiring Finance or Investment Professionals

Jumpstart your career by gaining the skills and knowledge to join one of the fastest-growing fields in finance..

Non-Finance Professionals

Learn to speak the language of alternative investments to better serve your financial services clients’ needs and become a more effective attorney, CPA, or overall colleague.

October 2020

Program Structure

Alternative Investments consists of approximately 30-35 hours of material delivered over a five-week period. You can complete the coursework on your own time while meeting regular deadlines.

Participants should have completed an undergraduate-level introductory finance course or equivalent at some point during their education and possess a basic understanding of capital markets, portfolio theory, and risk and return.

July 2020

Course Start Date: 29th July

Length: 5 Weeks

Regular price $1,600

Enrolment process needs to be completed 2 weeks prior of the program Start Date

October 2020

Course Start Date: 21st October

Length: 5 Weeks

Regular price $1,600

Enrolment process needs to be completed 2 weeks prior of the program Start Date

Syllabus

Alternative Investments will equip you with the skills, confidence, and strategies to assess potential investment opportunities in private equity, private debt, hedge funds, and real estate. You will learn how to speak the language of alternative investments, evaluate types of alternative investments and their defining qualities, and develop the confidence and ability to assess potential investment opportunities and maximize the value of your portfolio.

Learning requirements: In order to earn a Certificate of Completion, participants must thoughtfully complete all 5 modules by stated deadlines.

Syllabus

Alternative Investments will equip you with the skills, confidence, and strategies to assess potential investment opportunities in private equity, private debt, hedge funds, and real estate. You will learn how to speak the language of alternative investments, evaluate types of alternative investments and their defining qualities, and develop the confidence and ability to assess potential investment opportunities and maximize the value of your portfolio.

Learning requirements: In order to earn a Certificate of Completion, participants must thoughtfully complete all 5 modules by stated deadlines.

| Modules | Case Studies | Takeaways | Key Exercises |

|---|---|---|---|

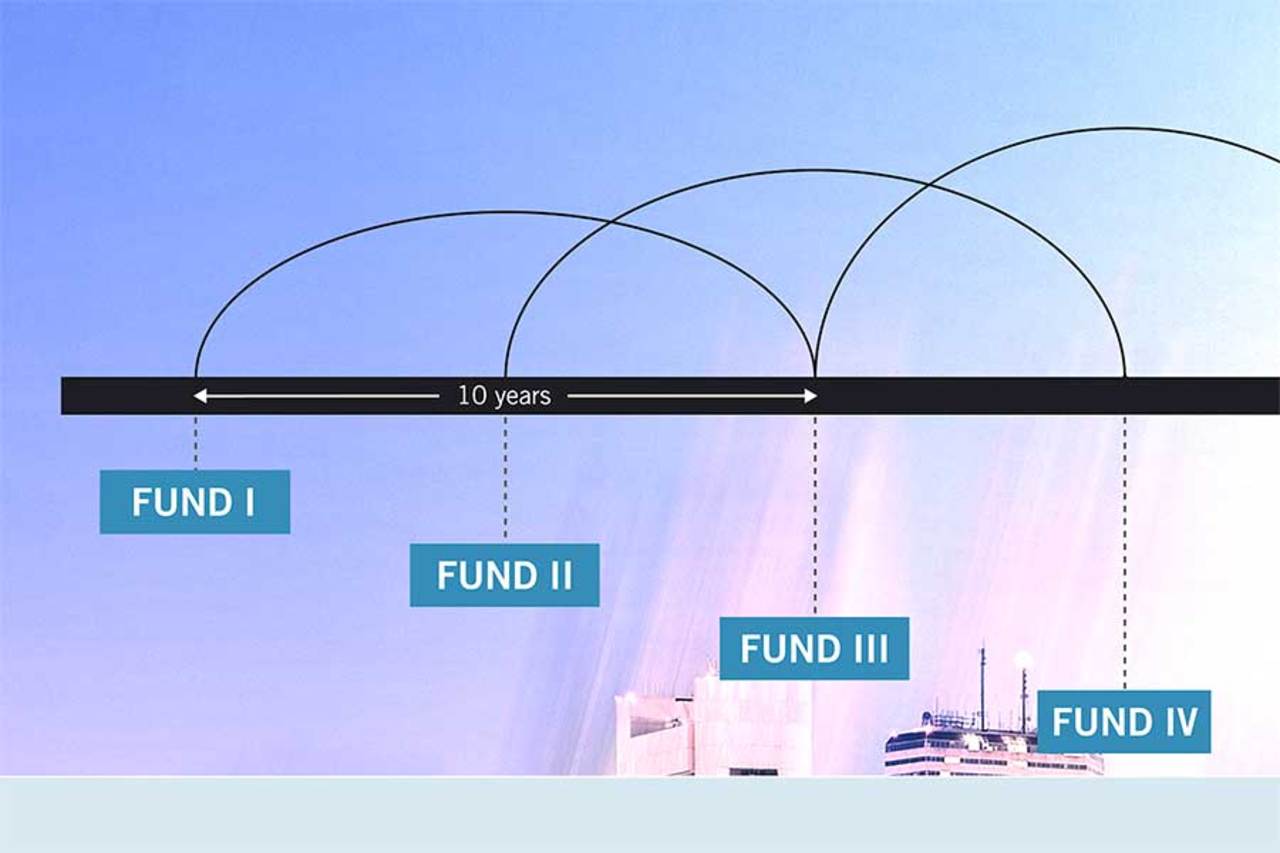

| Module 1: Private Equity |

|

|

|

| Module 2: Private Debt and Distress Investing |

|

|

|

| Module 3: Hedge Funds |

|

|

|

| Module 4: Real Estate Secondaries |

|

|

|

| Module 5: Portfolio Construction |

|

|

|

Stories from Our Learners

“HBS Online was an invaluable and essential education. The information provided, the quality of the presentation, and the high-level engagement among students surpassed my expectations.”

Rick Corbett,

Harvard Law School ’15

The platform was engaging, innovative, and allowed me to interact with the material in a way I never expected from an online course.

A few weeks into the course, accounting terminology came alive as I realized why accounting is the language of business. I can now talk confidently with clients and understand the business aspect of their problems.

Earn Your Certificate

Enroll today in Harvard Business School Online’s Alternative Investments course.

DISCLAIMER: This microsite, Its contents & communication provided is exclusively for the Students, Alumni & Faculty of Ansal University & unauthorized consumption of the same is prohibited.